Click here to download our Winter 2025 HVAC M&A Sector Update PDF

HARDI 2024 ‘Navigate’ Conference Recap

HVAC wholesale distributors and the wider HVAC community of HARDI members gathered in early December to discuss the current landscape and future outlook for the industry.

HARDI welcomed more than 2,000 attendees to its 2024 Annual Conference, Navigate, in Atlanta, GA, including 180 distributors and over 600 total members, (CMG is also a proud member of HARDI). This year’s conference boasted another record number of attendees, demonstrating the influence of the HARDI network and reaffirming the continued momentum in the HVAC industry.

Over the course of four days, the HARDI program focused on a wide array of topics ranging from macroeconomic outlooks, supply chain updates, the evolving regulatory environment, working effectively with the contractor / service base and business succession planning and M&A considerations.

CMG’s Key Takeaways

2025 Outlook: Be Proactive

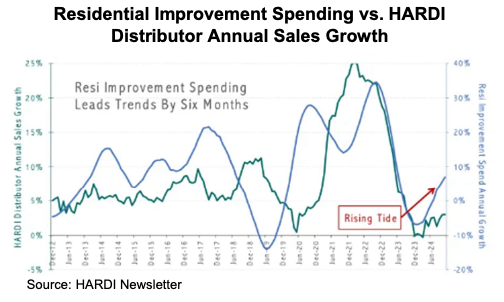

Navigate’s keynote economic outlook session highlighted improving market conditions for most HVAC channels and expected more upside for 2025, offsetting some lingering pockets of softness, particularly in new construction markets. With inflation steady and interest rates trending lower, market conditions suggest low single-digit – but positive! – sales growth, compared to the last few years of overall declines.

Because recent macro data suggests positive trends for the HVAC industry, a clear theme emerged throughout the conference – be proactive! Don’t simply rely on the market environment. Rather, focus on your customer base and how to upsell them in order to drive more business. Numerous HARDI workshops explored targeted ideas for how to better drive contractor engagement and sales. Interesting takeaways included:

- In-person training for contractors – Per a ‘Voice of the Contractor’ survey conducted by HARDI member firm Farmington Consulting Group, contractors prefer (by a margin of 2:1) to do product training on-site at their distributors, versus other venues. Distributors were encouraged to lean into this trend to drive loyalty and engagement.

- Focus on technology solutions – Contractors are increasingly turning to their distributors for the latest product information, versus OEM or third-party sites. Make sure your website or mobile apps can accommodate this preference. In addition, contractors are more apt to look for technical support virtually through online chat than ever before, emphasizing the importance of speed of service.

- AI use-cases are growing – While AI still feels like a buzzword, practical applications such as leveraging AI to analyze real-time data on inventory levels, pricing, and market demand are becoming more widely adopted with the promise of helping distributors optimize stock availability and make customized product bundle recommendations to ensure contractors continue to be well served. Time will tell how business models will further adopt AI, but early signs are positive.

Business Owner Considerations – Succession Planning and M&A Outlook

A key focus for our CMG team as M&A advisors for family-owned and founder-led businesses includes succession planning and M&A. Both topics tend to be scary to business owners, so it was nice to see packed conference rooms for events tackling these topics.

On the succession planning front, HARDI ran a workshop that emphasized a few key points:

- Many HARDI members are family- or founder-owned

businesses, making succession planning an important topic that closely held companies must address, but typically don’t until they are forced to. Start planning early! - Focus on objectives and what is important in a leadership transition, such as preserving owner / family legacy and operational continuity, particularly when family is involved. HARDI’s self-run ‘Emerging Leaders’ program (which CMG is an active participant) runs throughout the year and reinforces HARDI’s commitment to developing talent for its member’s long-term business success.

- Weighing the pros and cons of selling to strategic or financial buyers, rather than continuing to run the business independently.

M&A is obviously the other side of the succession- planning and was discussed openly at the conference. As far as the current landscape, here are some of our observations:

- 2025 M&A Outlook: From our family-and- founder business owner’s perspective, there was a decidedly more optimistic tone around exploring M&A than in 2024. Following a few years of sales & profit volatility, we expect a steadier year operationally will have owners more open to considering M&A rather than triaging their businesses.

- Buyer Enthusiasm for M&A: In turn, we met with many strategic buyers and investors who were enthusiastic about continuing their M&A programs to supplement organic growth. The HVAC distribution industry, as the focal point for mission critical equipment and services, is still highly desirable from an investment standpoint.

- Focus on Finding the Right Partner: For owners set on exploring M&A, focus on aligning with a buyer or investor who shares a similar vision and values as the Company. Owners should look beyond simply the highest dollar amount to ensure that other objectives important to them (i.e. legacy, employees, growth) are addressed. As always, having a trusted team of M&A advisors to help navigate a complex sale process is a key aspect in maximizing value during an M&A process.

Expert Interview: Insights into Strategic M&A

Featuring Eric Ancarrow, VP, Business Development, Ferguson Enterprises (NYSE: FERG)

Carter Morse & Goodrich recently interviewed Eric Ancarrow, Vice President of Business Development at Ferguson (NYSE: FERG). Eric’s responsibilities include developing relationships with independently-owned distributors for the purpose of sourcing and executing strategic M&A opportunities. At $40 billion of total enterprise value, Ferguson stands as the largest value-added distributor in the North American residential and non-residential construction market, providing a broad portfolio of products and services that includes plumbing, HVAC and building products, among others.

Organic Growth vs. M&A

In your role leading M&A initiatives for Ferguson, how do you think about acquisitions as a complement to organic growth? Historically, Ferguson has been a very active acquirer—11 deals last year alone, which some might even call a slow year. How does M&A fit into the broader strategy and culture of the organization?

Acquisitions have been part of Ferguson’s growth algorithm for nearly 30 years – in that time we have completed over 300 transactions. This inorganic growth has allowed us to not only expand geographically, but enter into new verticals including HVAC, Waterworks, Fire Protection and digital commerce. M&A is embedded in our culture with over 15% of our current associate base, including our CEO, coming to the company through acquisition. We target 1-3% annualized incremental revenue growth through M&A, and work closely with our business leaders to ensure our M&A strategy aligns with our customer group and broader corporate strategy.

Pipeline & Market Outlook

How does your current M&A pipeline look, and could you share any high-level initiatives or trends you’re focusing on? What’s your perspective on the overall market for sellers in the HVAC sector compared to the broader plumbing and building products sectors right now?

Our pipeline has remained robust even as 2024 has been seen more broadly as a slower year for transaction volumes. We operate in highly fragmented markets across all of our customer groups and anticipate continued consolidation for years to come.

While Ferguson continues to invest in M&A across all our verticals, we have been most active in the HVAC and Waterworks space. We believe Ferguson is best positioned to serve the dual trade contractor through our HVAC and Plumbing network and believe the consolidation we have seen in the HVAC service and contractor markets will create further opportunity to grow with this customer. We have also been diversifying our Waterworks business through M&A, investing in areas like erosion control, stormwater management, metering and technologies and plant work.

Pitch to Family & Founder Sellers

Many of our family- and founder-led clients hear pitches from private equity, touting continued independence, legacy preservation, and a chance to remain deeply involved. Why should these sellers consider Ferguson as a potential partner instead?

Ferguson very much values the heritage and legacy of an independently owned wholesaler. Our industry is dominated by family-owned, multi-generational businesses with active family members still leading the business. We recognize a potential sale is an incredibly tough, and emotional decision when determining who the family would like to partner with moving forward.

Often times a sale represents a full exit of the business for the family, but just as often we are working with Seller’s who wish to remain involved. Having leadership stay on post-close is invaluable, providing stability to the business, associates and customers and helping us build on what has already made that company successful. We very much value the entrepreneurial spirit and passion of the owners and their teams, and look to leverage throughout our business.

We acquire companies that have a strong value-set match with Ferguson and our acquisition model is one of investing in the company and the associates to fuel growth – giving them access to expanded product categories and helping them to leverage our national scale using their local relationships. The focus for us, from an integration perspective, is on bringing those associates into the Ferguson family, on opening up new career opportunities for them, and then bringing the capabilities that we offer as a $30 billion organization to those associates and to their customers.

We hope seller’s see that as an attractive value proposition and one in which they are best setting their employees up to succeed.

Advice for Founder-Led Companies

Given your experience, what advice would you give to family and founder-led businesses considering an M&A transaction—particularly around preparation and positioning for the right partner?

There are a lot of fundamental considerations a Seller needs to address. While that starts with understanding the goals for the family and shareholders, you’ll want to work close with an advisory team around more complex issues such as tax, legal and estate planning.

As you think about positioning the company for sale, the best advice I could give would be to invest in your people and position them to grow. It’s the people and the relationships that are the most important asset in any acquisition and the largest value driver to a strategic acquirer.

CMG Transaction Spotlight

CMG advises Arista Air Conditioning in its sale to a Confidential Strategic Buyer

Business Description

Founded in New York City more than 75-years ago, Arista has grown into one of the largest independent HVAC contractors for service, repair, maintenance, and retrofit installation, serving customers throughout NYC’s five boroughs, Long Island, Westchester and New Jersey. The name “Arista” means “the best” in Greek, and true to its name, the Company built a stellar reputation as the preferred partner for a prestigious and diverse client base in both commercial and high-end residential markets with its fleet of 100+ vehicles and service technicians.

Transaction Background

Arista is a second-generation family-owned business. Stanley Berger, representing the family’s first generation, originally served as Arista’s accountant, and purchased the Company in 1973. Stanley immediately began expanding Arista’s service offerings and footprint and soon welcomed his children to join the business. Stanley’s son Scott took over as President in 2004 and continued his legacy of industry leadership. In 2024, the Berger family decided to explore strategic options to determine the next chapter in Arista’s legacy and partnered with CMG and a team of other transaction professional.

CMG’s Solution

CMG’s Solution

After fielding numerous inquiries from interested buyers over the years, Arista engaged CMG to conduct a strategic options analysis for the Company to help the Berger family decide whether to explore a sale. Following the outcome of CMG’s analysis, Arista mandated CMG to conduct a targeted M&A sale process for the Company. A large confidential HVAC corporation, seeking to enhance its service capabilities and expand its reach in the Northeast, emerged as the best fit to continue the Company’s legacy of excellence and successfully acquired Arista.

Owner’s Perspectives

Scott Berger, Arista’s President, commented, “At first, I was skeptical about hiring an investment banker for our sale, since strategic parties had already approached me about a transaction. But after meeting the Carter Morse team and witnessing their M&A expertise, knowledge of the HVAC space, and direct connections to buyers interested in Arista, I knew they were the right partner for us. From that point on, they proved I had made the right choice. They supported us at each turn and truly cared about every detail of my family’s business, doing whatever it took to make this a successful transaction for us. I can’t recommend them highly enough.”

Upcoming Industry Events

AHR Expo

February 10 – 12

Orlando, FL

MCAA 2025 Annual Convention

March 2 – 6

Austin TX

Contact Us

Whether you are actively considering an exit or just curious about options for the future, we would love to connect, learn more and truly understand your objectives. We are happy to share our insights and help explore strategies to maximize the value of your company and enhance the legacy of your business.

Ramsey Goodrich

203-349-8375 (Direct)

203-554-2435 (Mobile)

RGoodrich@CarterMorse.com

Christopher Reenock

203-349-8376 (Direct)

917-334-1739 (Mobile)

CReenock@CarterMorse.com

Geoff Bradley

203-312-4587 (Mobile)

gbradley@CarterMorse.com