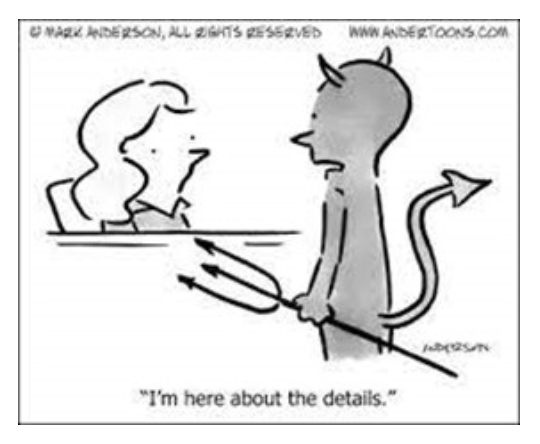

The Devil is in the Details

Why Quality of Earnings Reports are becoming ‘standard operating procedure’ for sellers.

In M&A deals, sellers benefit significantly by being proactive and investing in a sell-side Quality of Earnings report (“QoE”) before going to market. This report will highlight areas to increase proforma adjusted EBITDA-C, thereby increasing value. A QoE provides comfort to the buyer that the financials provided are accurate and dependable.

What is a QoE report?

Typically prepared by an accounting and advisory firm, a Quality of Earnings report is a detailed analysis of all the core components of a company’s financial status. The analysis includes adjustments for non-recurring or owner related expenses and/or excluded assets or business lines, and presents a post-closing adjusted financial picture that becomes the basis of negotiations for both the buyer and the seller. While QoEs were traditionally limited to the buy-side on larger deals, it is now standard operating procedure for middle market sellers to provide them.

Do I really need one?

In our opinion, YES! We strongly recommend that our clients pre-empt the buyers’ due diligence by investing in their own analysis (a ‘sell-side QoE’). This presents the most favorable and accurate financial picture possible, thus avoiding surprises and staying ahead of any potential issues. By being proactive, sellers can decrease the time required to close a transaction, maximize value (based on adjusted results), minimize stress (knowing that all issues have been addressed) and give a buyer more confidence in the company and its management.

I have Audited Statements, isn’t that enough?

An audited financial statement presents financials that are reported in full accordance with GAAP and serves a very different purpose than a QoE. Principal differences in audits versus a Quality of Earnings reports include:

- A QoE report includes an analysis of revenue trends and gross profit margins, which an audited financial statement would not

- Under GAAP, the impact of non-cash items (e.g. stock compensation), owner’s expenses and one-time items (e.g. insurance or legal settlements) would be included in the period in which they occur; in a QoE these items would be adjusted in arriving at EBITDA-C (C = Covid-19 impact)

- An audit report would not include a comprehensive working capital analysis typically included in a QoE

- QoE EBITDA-C analysis includes the pro forma impact of discontinued business lines or acquisitions that would not be presented audited financial statements

- The scope of a QoE analysis typically includes an analysis of the last three full fiscal years and the most current twelve month (TTM) period where audits typically cover only the latest fiscal year end

A QoE helps formulate an opinion on the quality of the financials not just the quantity. It can help identify and justify add-back adjustments, normalizations and eliminations to the financial statements due to non-recurring expenses, owner expenses, and other anomalies. These adjustments often increase proforma earnings and support a higher valuation.

Can you afford not to have one? (Expense vs. Cost)

The expense associated with hiring a reputable CPA firm to perform this analysis is not insignificant. Depending on the complexity of the business and availability of information, business owners can expect the project to cost between $50,000 to $150,000. Typically, however the cost of a QoE report is insignificant in relation to the total value of the transaction.

Consider, however, the potential benefits of a QoE (and the cost of not having one performed)

- Increase Purchase Price: Suppose the QoE justifies a $100,000 positive adjustment to EBITDA for a transaction valued at 8x EBITDA. The resulting increase in a purchase price would be $800,000, well more than the cost of the QoE.

- Control the conversation: By identifying issues in advance, sellers can address problems before the buyer ever gets involved, on their terms and their timing. The QoE can help sellers control the conversation around these issues.

- Speed and certainty of close: Presenting a full sell-side QoE gives the buyer great confidence that there will be no surprises and, as a result, their financial due diligence investigation will often be “lighter” and faster.

Final Thoughts

A QoE is not only justified in middle market transactions but is becoming an expected exercise. A QoE report may just be the best investment sellers can make when it comes to maximizing value.

We are Here to Help

If we can help you maximize your outcome, please do not hesitate to reach out to any one on our team.