Unsolicited offers to acquire your business can come as a surprise. Active professional acquirers (both strategic buyers and private equity investors) use M&A as a driver of growth and proactively reach out to targeted businesses regularly to evaluate potential acquisitions. Before opening the door, it is important to evaluate the opportunity and respond accordingly.

Understand who is on the other side of the door

While most interest is certainly genuine, some groups may simply be kicking the tires or fishing for information. Beware of the ‘blanket buyside’ letters that implies an unidentified buyer, they rarely result in a successful outcome. However, if there is an identified buyer with a legitimate interest and compelling rationale, it may be worth considering.

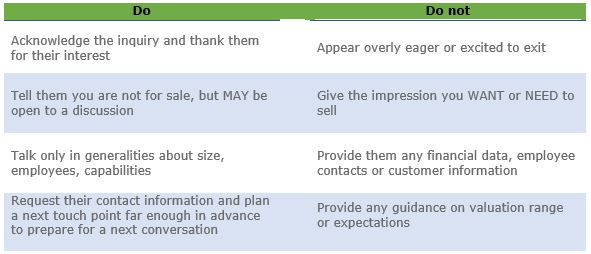

Set the tone with the initial response

Be a good listener, understand who is at the door and why they are interested and learn what they already know about you. You can determine if the interest is legitimate while also gathering important market intelligence.

Sharing too much information has its risks: the rumor mill can start to churn within the market and your employees, sensitive information can end up in the wrong hands and there can be a big distraction from the core operations of the business. Being overly eager can also hurt your negotiation leverage and might lead to a potentially lower value.

A Choice of One is not a choice at all

Rarely does the first knock on the door present the highest value or the best possible partner for the business. Professional buyers never submit their best offer first, so it is OK to say “No”. The buyer will not be offended and will still be interested when you are better prepared for the conversation.

Even if the offer is attractive, adding competition (either real or at least perceived) is the best way to maximize value. Be prepared to engage with others and develop a competitive environment.

Get Your Team in Place

Assemble the right team to help you navigate the process. A well-rounded team requires expertise from a range of professionals, including an investment banker, attorney, accountant, tax advisors, estate planners, wealth managers and even family counselors. This team of experts can help you:

- Clarify your near-term and long-term business needs

- Understand personal objectives and determine if a transaction achieves them

- Assess readiness for a transaction, for both the business and the owners

- Offer a clear picture of legal risks and implications

- Identify potential tax saving strategies

- Establish a wealth management plan – how much is enough?

- Determine if that amount is realizable in a transaction

- Evaluate the attractiveness of your suitor knocking at the door as a buyer or potential new partner

- Identify and approach the best possible partners given the objectives, if needed

- Manage a disciplined and accelerated process to get to closing

Getting an offer is NOT the goal

Many sellers believe the hard work is done once an offer is received. It is not. The offer never gets better after saying “yes” so planning and preparing before the offer arrives is critical. If that knock becomes interesting, take the time to prepare for a successful process and the best possible outcome.

Conclusion

There are no shortcuts. A successful transaction, either responding to a knock on the door or a fully-prepared competitive sale process, requires a substantial investment of time, resources, energy, and mindshare. Selling your company is a ‘once-in-a-lifetime’ event, you deserve the best possible outcome for your years of hard work, sacrifice and dedication.

We are here to help

Whether responding quickly to an unsolicited offer or laying the foundation for a longer-term exit strategy, our team is prepared to help guide you through a successful process.